Estate Planning Challenges for Business Owners in 2019

February 15, 2019

Publications

Estate Planning Challenges for Business Owners in 2019

By: Andrew Rusniak

Reprinted with permission from the February 15, 2019 edition of The Legal Intelligencer © 2019 ALM Media Properties, LLC. Further duplication without permission is prohibited. All rights reserved.

As we move into 2019, business owners face many challenges and uncertainty with respect to the tax and legal landscape involved in estate planning and succession planning due in large part to the continuing impact of the Tax Cuts and Jobs Act of 2017 and the impact of rising interest rates on planning techniques commonly utilized by business owners to successfully transition ownership of a business in a tax efficient manner.

The Tax Cuts and Jobs Act of 2017 (the TCJA) was signed into law on Dec. 20, 2017, with an effective date of Jan. 1, 2018. By now, most individuals who have potential exposure to the federal estate tax, and advisers who represent such clients, are well aware that the TCJA amended the federal estate, gift and generation-skipping transfer tax laws in a number of significant ways, including, most notably, the temporary doubling of the basic exclusion amount from $5.49 million ($5 million with a $490,000 inflation adjustment) for gifts made, and for decedents dying, in 2017, to $11.4 million ($10 million with a $1.4 million inflation adjustment) in 2019. As a result, this year spouses are effectively able to shelter a combined $22.8 million from federal transfer taxes with appropriate planning. The basic exclusion amount will continue to increase annually based on inflation indexing through 2025, at which point the exclusion amount will sunset to pre-TJCA levels. Current estimates are that the basic exclusion amount in 2026 will be somewhere in the range of $6.2 million to $6.4 million per person.

The impact of the TCJA on estate planning for all high net worth clients is undeniable, but legislation’s impact is particularly relevant to owners of closely held businesses. Many clients with highly successful businesses are contemplating whether to utilize the increase in the basic exclusion amount before the end of 2025 or before additional changes are made to the federal transfer tax laws. One factor weighing heavily on that decision in recent months is the impact of rising interest rates on common planning techniques that have routinely been utilized to great effect over the last 10 years in a low interest rate environment.

Calendar year 2018 ended with the Federal Reserve’s fourth interest rate increase that year, which marked the ninth increase since the Fed began raising rates approximately three years ago. It is presently projected that the Fed will raise interest rates twice in 2019. The global rising of interest rates will directly impact estate planning for business owners in 2019, as many common estate planning techniques utilized by business owners to successfully transition ownership of a closely-held business and to leverage the owner’s basic exclusion amount rely on intra-family and related-party loans. These loans are generally structured to minimize the interest required to be paid to the seller. Rising interest rates means that intra-family and related party lending will become costlier, and the hurdle rate for certain planning techniques will increase.

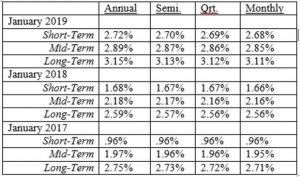

Every month the IRS publishes a table of the applicable federal rates (AFRs), which sets the minimum amount of interest per compounding period that can be charged on private loans in order to avoid loan re-characterization and the imputation of interest. The IRS publishes three rates: the short-term rate, which is used for loans with terms under three years; the mid-term rate, which is used for loans with terms between three and nine years; and the long-term rate, which is used for loans with terms longer than nine years. The following chart illustrates the increases in AFRs over the last 3 years:

The IRS determines the AFRs based on average market yields from marketable obligations, such as U.S. government Treasury bills. With the Fed planning to continue to raise interest rates into 2019, it is anticipated that bond yields will continue to trend upward, and the IRS will continue to correspondingly increase AFRs.

At the most basic level, a business owner will often sell an interest in a closely-held business to one or more members of the next generation to entice the buyer to remain in the family business or to begin the process of succession. It is common for the purchase price to be paid in large part with seller financing over a term of years and funded with distributions from the business. Assume that the sole shareholder of a family business wants to sell $1 million worth of nonvoting stock to a child who he intends to succeed him in running the business. If the selling shareholder took back a nine-year note in January 2019 using the 2.89 percent mid-term AFR for annual compounding in the full amount of the purchase price, then over the term of the loan the child would pay, and the seller would recognize, $136,878.29 of interest. Had the loan been made in January 2018 or January 2017, the total interest accrued over the term of the loan would have been $102,694.58 or $92,086.73, respectively.

Sales to intentionally defective grantor trusts (IDGTs) are another common planning technique to remove closely-held business interests from a client’s taxable estate. An IDGT is a trust that does not exist for Federal income tax purposes but does exist for federal estate tax purposes.As a result, a business owner may “sell” interests in the business to the IDGT in exchange for a promissory note. Because the trust is structured as a grantor trust for Federal income tax purposes, the sale is not recognized and is therefore not subject to capital gains tax (although it is recognized for Pennsylvania income tax purposes). However, because the transaction is structured as a sale, there is no gift for federal gift tax purposes, and the business owner’s basic exclusion amount is preserved (less the seed money required to fund the trust if the IDGT is newly established). The result is that the property sold to the trust is able to appreciate in value outside of the business owner’s taxable estate. Generally, the promissory note received by the seller in a sale to an IDGT is structured to charge the least allowable amount of interest by utilizing the AFR for the appropriate term and is paid by the trust with distributions from the business. As was the case in the above example, as AFRs continue to rise the cost of borrowing increases for the trust, and the business must make larger distributions to cover the note payments.

Grantor retained annuity trusts (GRATs) also become less attractive in a rising interest rate environment. A GRAT is a traditionally low-risk wealth transfer vehicle used by clients to move appreciating, income-producing assets (like closely-held business interests) out of the client’s taxable estate. The basic premise of a GRAT is that the grantor will make a gift of property to the trust and will retain a right to receive fixed payment amounts over the term of the trust. At the end of the GRAT term, the trust will terminate, and the remaining assets in the trust will pass to the beneficiaries selected by the grantor when establishing the trust. Because the grantor retains a significant interest in the trust, only the actuarial value of the remainder interest is subject to gift tax. The grantor will calculate the value of the remainder interest using an assumed rate of return as set out in Section 7520 of the Internal Revenue Code (the 7520 rate). Like the AFR, the 7520 rate is issued monthly by the IRS and is equal to 120 percent of the mid-term AFR (compounded annually) for the relevant month. The January 2019, 7520 rate is 3.4 percent. In January 2018, the 7520 rate was 2.6 percent, and in January 2017, the 7520 rate was 2.4 percent. A GRAT funded in January 2019 with $1 million of assets that produced a 10-percent rate of return would be able to transfer $687,055.92 to the GRAT remainder beneficiaries without gift tax. Had that same GRAT been funded in January 2017, the grantor would have been able to transfer $782,157.69 to the remainder beneficiaries without gift tax.

With the uncertainty surrounding the long-term availability of the increased basic exclusion amount, and with the prospect of additional interest rate increases on the horizon, business owners face many challenges and uncertainty with respect to estate planning in 2019. What is clear, however, is that the successful transition of a closely-held business is very closely tied to a thoughtful estate plan. Therefore, a routine and periodic review of even a well thought out estate plan is recommended for all clients and, in particular, for business owners who want to take advantage of the tax laws and interest rates before there are additional changes to the current tax and legal landscape.

Andrew S. Rusniak is an attorney with McNees Wallace & Nurick in the firm’s estate planning and corporate & tax practice groups. Rusniak represents individuals, families, business owners, executives and professionals in all aspects of tax and estate planning, business succession planning, asset protection planning, charitable planning, and estate and trust administration. His practice focuses on advising closely-held businesses and high net worth individuals. He practices out of the firm’s Lancaster and Harrisburg offices.